The automotive sector is one of the most growing industries in Europe. Its constituent companies manufacture automotive products or are in some way related to the industry. The fact that the automotive industry is one of the key branches of the EU economy is not insignificant. According to recent calculations, it accounts for 7% of the European Union’s GDP; provides employment for 6% of European workers, and generates 12% of the value of exports, yielding a surplus of more than 84.4 billion euros. Each year, automotive companies invest €57.4 billion in R&D, accounting for 28% of the value of EU research and development (R&D) expenditures. Also closely related to the automotive industry are all areas around automobiles, such as automotive financial services (insurance and credit), transportation services, leasing, road infrastructure and fuel production and sales.

Of all the technological breakthroughs of the 21st century, few have had as big an impact on the world as e-commerce. Virtual sales channels are driving the growth of today’s largest companies. The e-Commerce market has changed the way consumers and companies choose products and interact with brands. However, in the automotive industry, this revolution is occurring with great slippage. In 2017, online sales in the industry’s major markets amounted to only 1.5%. That’s 10x less than in the tech industry. However, all experts predict that despite these peculiarities, online sales of parts will grow. There are already large players trading these goods in the e-commerce market, and the coronavirus outbreak has only accelerated the process.

The SARS-CoV-2 pandemic has unleashed e-commerce in industries such as FMCG, beauty and electronics. In the future, e-commerce can also be expected to play an increasingly important role in the automotive industry, although it is difficult to imagine that a driver can successfully select, for example, the right clutch for his car. It seems that e-commerce will necessarily affect traditional sales. Online prices are often a reference for us – especially when making larger purchases. The Internet may struggle especially for DIY repairs.

The pandemic has forced businesses to adapt their operations to new realities. While many tasks and duties are performed remotely, this is not the case in industries with manufacturing at their core. Despite such difficulties, some entrepreneurs point out that selected elements of their business can be carried out via the Internet. A special potential lies in sales, as some solutions in this area are already being used.

The automotive sector represents the second largest sector in Poland. Its continuous development since the beginning of the political changes in our country has resulted in the fact that it is now one of the most solid foundations of our country’s economy. Over the past decade, Poland’s automotive industry has experienced 100% growth as measured by sold production. This not inconsiderable success, making automotive the second largest industrial sector in Poland (10.1% share), is not a matter of chance, but the result of consistent work by entrepreneurs and the country’s investment attractiveness. Both in terms of absolute numbers and in qualitative terms, Poland in this part of Europe is the country with the largest number of working-age people with solid technical education, both at the secondary and tertiary levels.

Despite a recovery in demand, the effects of the coronavirus crisis could still be felt by parts and components manufacturers this year. A recent survey by Santander Bank Polska shows that two-thirds of the country’s automotive companies expect revenue growth this year compared to pre-pandemic 2019, while only 17 percent of respondents see a drop in demand as a potential threat.

Automotive companies should adapt to current capacity and employment needs, actively participate in the development of new projects, use modern technologies, make improvements to existing production processes to simultaneously maximize productivity and minimize labor intensity.

The aftermarket is not exactly the same as other major online sales sectors. To succeed, the industry must recognize and overcome many challenges. First, a small number of car users have the skills and enthusiasm to do more than basic maintenance and repair work with their own hands. It’s no coincidence that the best-selling replacement parts on the Internet are those that are easiest to install yourself, such as light bulbs or wiper blades.

Bibliography and sources:

https://www.paih.gov.pl/sektory/motoryzacja

https://www.parkiet.com/Przemysl/302179988-Branza-automotive-liczy-na-odbicie.html

https://www.pb.pl/rynek-motoryzacyjny-cofnal-sie-o-trzy-lata-1102434

https://new.siemens.com/pl/pl/o-firmie/aktualnosci/raport-na-temat-branzy-automotive.html

https://motofocus.pl/informacje/nowosci/89200/covid-19-wplynal-na-rozwoj-e-commerce-w-automotive-tez

https://www.gminsights.com/industry-analysis/automotive-regenerative-braking-market

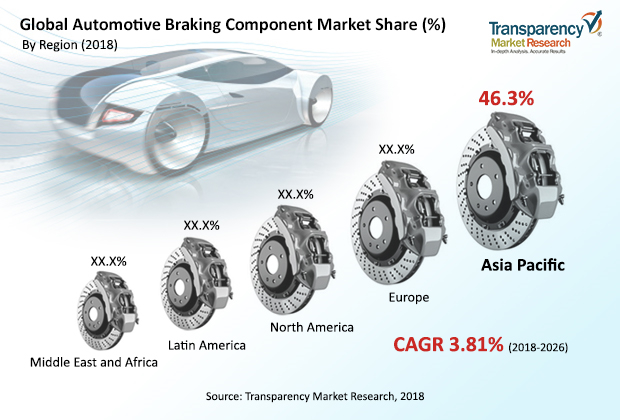

https://www.transparencymarketresearch.com/automotive-braking-component-market.html

MBF Group

MBF Group