(March 22, 2024)

DEVELOPMENT STRATEGY FOR 2024 – 2026

Our Vision

We aim to be a leading company in the field of comprehensive wholesale and commodity trading services and a leading broker in the Polish and European markets.

Who are we?

We offer professional assistance regarding intermediation and direct wholesale trading of goods in the Polish and European markets. We provide comprehensive services in terms of legal assistance, bid verification, delivery organization and logistics. We specialize in dealing with reliable suppliers and manufacturers for the following products: food, agricultural, chemical and technical.

We represent the interests of the buyer or seller of products. Our task is to negotiate and conclude transactions on behalf of the companies we represent on the basis of medium or long-term contacts. We perform a thorough analysis of transactions and, based on this, draw up secure commercial contracts for the supply of goods on behalf of ourselves or our contractors.

Reasons for the decision to change

The last officially adopted and published development strategy of MBF Group SA is dated October 17, 2017 (as amended). Over the past few years, the company’s operations have been regularly modified, until we have reached the point where it is necessary to change it completely by abandoning projects and services that are not de facto.

At the same time, the updated Development Strategy should include and describe all the activities behind the company’s current revenue structure and its actual business operations.

The audited separate and consolidated Annual Report of MBF Group SA, published on March 20, 2024, proved that the groundwork done in earlier years to expand the business into new earning areas is justified. After careful analysis, it was decided that the new business areas should become MBF Group SA’s primary sources of revenue and profit (so-called Core-business).

This update of the development strategy is also necessary in response to the changing business environment, internal and external factors affecting MBF Group SA’s operations, and to maintain competitiveness and achieve business goals.

Main Strategic Objectives

- Triple sales revenue by 2026

- Expanding offerings with new products with high margin potential

- Obtaining a license from the Ministry of Internal Affairs and Administration to trade in arms and ammunition this year

- Entering new foreign markets

- Exclusion of non-core-business operations from the Group

- Gradual reduction in operating costs

Key steps for implementing the Strategy

Expansion of supplier and partner network:

In order to ensure a diverse range of products and competitive prices, the company will continue to develop its network of suppliers and business partners. There will be an expansion of cooperation with existing suppliers and a search for new, proven players.

Diversification of product offerings:

In addition to the leading product category – cooking oils, sugar, urea – new goods will be added that can meet market needs. Starting in Q2 2024, military and automotive products will be added to the portfolio. The company will also apply for relevant permits and licenses.

Introducing innovative logistics solutions:

To ensure fast and efficient deliveries, the company will invest in modern logistics technologies such as route optimization and warehousing.

Expansion into new markets:

Despite its focus on the Polish and European markets, the company will consider expansion into other markets. Analyzing potential target markets, understanding local consumer demands and trends, and establishing partnerships with local players will enable success in new markets.

Investment in marketing and promotion:

To increase MBF Group’s brand awareness and attract new customers, the company will invest in marketing and promotional activities. This can include online and offline advertising campaigns, participation in trade shows and activity on social media platforms.

Monitor trends and adjust strategies:

The commodity trading and trading industry is dynamic, so it is important to monitor market trends, regulatory changes and market behavior. On this basis, the company will quickly adjust the implementation of its development strategy to remain competitive and meet changing market demands.

Capital requirements

As of the date of adoption of the updated Development Strategy for 2024 – 2026, the Company’s Management Board does not see a need to subsidize MBF Group SA in the form of a share capital increase through the issuance of shares with or without pre-emptive rights.

Notwithstanding the above, a resolution will be proposed at the next Annual General Meeting of Shareholders, giving the Board of Directors the flexibility to increase the share capital by resolution (increase within the authorized capital). The previous authorization has expired and has not been used, but such a tool the company’s Board of Directors should have in case there is an investor or a sudden need for capital.

The above also does not preclude the Management Board’s efforts to obtain a permanent line of credit or an investment loan from a commercial bank or other entity supporting the development of enterprises, such as the Polish Development Fund, the Polish Agency for Enterprise Development, European Funds and others. (grants, subsidies, soft loans).

In the opinion of the management of MBF Group SA – in order to increase the scale and efficiency of operations, the Company, along with the development of its activities, should accumulate even greater capital resources, so as to be able to order a larger volume of goods, which will result in much more favorable purchase prices.

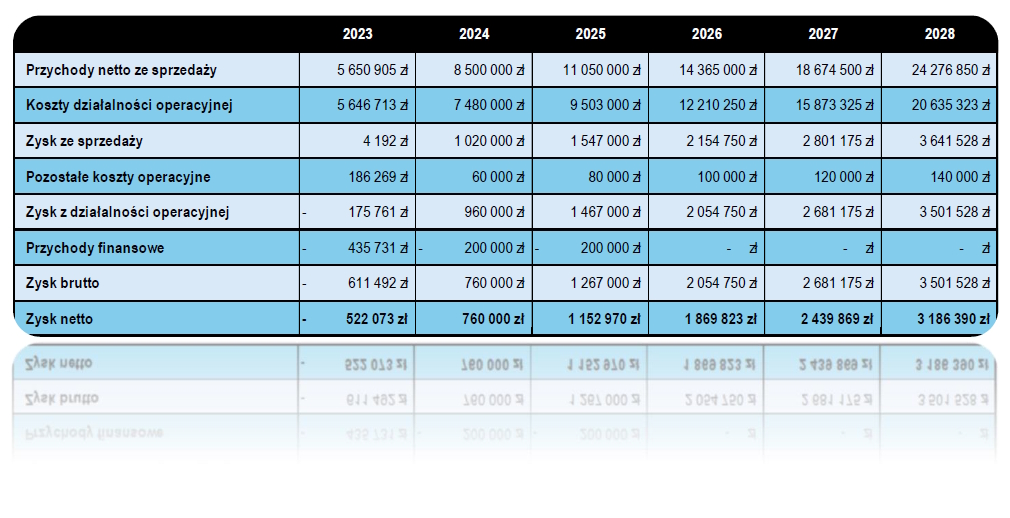

Financial assumptions for 2024 – 2028

Assuming all of the above, critically evaluating the currently signed agreements and contracts, and taking into account the current negotiations and working meetings, the MBF Group SA Management Board estimates that the proper implementation of the Development Strategy for 2024 – 2026 should bring the company the following financial results:

The above estimates do not include extraordinary events (positive and negative) and contracts that may be realized as the scale of operations grows, and today are difficult to estimate in terms of execution (e.g., regular shipments of goods in volume).

Note: the above estimates are not an official financial forecast, which will be published with the relevant ESPI Current Report, if required.

MBF Group

MBF Group