We can historically consider the first half of this year as the best period for the company. The financial result for the second quarter of this year represents a surge in revenue on both a standalone and consolidated basis. As we have written more than once before, the particular nature of the conduct of our business means that the financial result is seen at the very end when the transaction is contracted and settled or the goods are physically delivered to the final customer. We are now beginning to collect the concrete result of this work. Thank you to everyone who had confidence in us and can now rest assured about the decisions made.

In the second quarter of the current one, however, the company saw significant achievements in terms of the Company’s powerful revenue growth, which have an intrinsic connection to the previous months, where the Issuer conducted intensive negotiations, talks and consultations on contracting cooking oils, urea, coal and diesel. Regardless, we are steadily expanding our offerings and brokerage services and hope, in the near future, to sign more contracts with producers and companies in the food (sugar and other products) and agricultural (grains, seeds, oils, etc.) industries.

No less important for the life of the company was the finalization of talks with an equity fund from the United Arab Emirates. The signing of the agreement could be of great positive significance for the next few years in the operation of MBF Group SA. As mentioned above, the financial result for II represents a surge in revenue on both a standalone and consolidated basis. As we have written more than once before, the particular nature of the conduct of our business means that the financial result is seen at the very end when a given transaction is contracted and settled, or the goods are physically delivered to the final customer. And now we are beginning to collect the concrete result of this work.

On a standalone basis, we recorded the Company’s revenues at PLN 2,962,558 (!) (vs. PLN 20,127 a year earlier). Operating expenses amounted to PLN 1,147,087, but in this case we have to pay attention to a very important element of this item, since all costs related to the current revenue were not included there, as a large part of them appeared only at the beginning of July, that is, de facto in the third quarter (a very important issue in assessing the final result for the first half of the year). The quarter was closed with a gross profit of PLN 1,811,965, and cumulatively PLN 1,586,243. There is also a jump in our balance sheet total from PLN 7,563,430 to PLN 13,345,078, which includes increased values in the accounts receivable and accounts payable items (i.e., settlements of contracts under delivery and execution). In view of the achieved result, the increase in equity at the end of the period is also noteworthy – it currently closes with a sum of PLN 7,738,038 (against PLN 5,972,252 a year earlier).

The parent company’s financial result is overwhelmingly responsible for the consolidated result. Cumulatively after the second quarter, consolidated revenue amounted to PLN 2,979,343 against PLN 48,146 a year earlier. Consolidated gross profit, on the other hand, was PLN 1,736,826, compared to a loss of 230,343 a year earlier. Consolidated total assets grew from 8,925,219 last year to 15,231,907 after the second quarter of the current year.

A clash in the Company’s operations was the auditor’s refusal to issue an opinion. We included our assessment of the auditor’s work in the body of the annual report and in an expanded manner in the information submitted to the Polish Audit Oversight Agency, and we do not intend to return to it. The refusal to issue an opinion, which we learned of moments before the deadline for publication of the annual report, resulted in the suspension of trading in the shares on the NewConnect market.

The Issuer’s Management Board is of the opinion that the submission of the audit report, which includes the refusal to issue an opinion (very carefully explained and described) – regardless of the Issuer’s position towards the refusal to issue an opinion – constitutes and contains a true, fair and complete picture of the audit report. In addition, the report allows investors to assess the impact of the information provided on the economic, property and financial situation of the issuer or on the price or value of the listed securities. On the basis of the auditor’s report, together with the relevant commentary of the management and supervisory board, investors and Shareholders can make their own assessment of the current situation and then react to it by selling or buying shares, or by refraining from selling or buying shares. Unfortunately, the Stock Exchange did not share our view in upholding the suspension resolution.

Regarding the placement of our company on the double-fixing, if we remain on it, it will be a situation we do not understand from the WSE. We were put there because they refused to give an opinion. Now the opinion will be issued, so the reason will disappear. If we don’t return to continuous trading right away, it will only show that we could have published nothing (as other canny companies have done). The only thing that would happen to us would be a suspension, and after publication, a suspension. We have shown everything we have without hiding – for now we are suffering because of it, by the way, it is not even so much the company that is suffering, because we are scoring the best year ever, but the Shareholders.

Notwithstanding the above, the Company’s commitment to make adjustments to the 2022 financial statements without delay in order to have them re-audited by an independent auditor and then approved by the Annual General Meeting of Shareholders remained in effect. The issuer terminated its contract with the previous auditor and immediately entered into an audit contract with a new auditing firm. This time cooperation is at the highest possible level. We expect publication of a revised annual report in the 37th week of this year. The Company’s Management Board offers full readiness and has complete documentation and explanations for the re-examination of the Issuer’s reports.

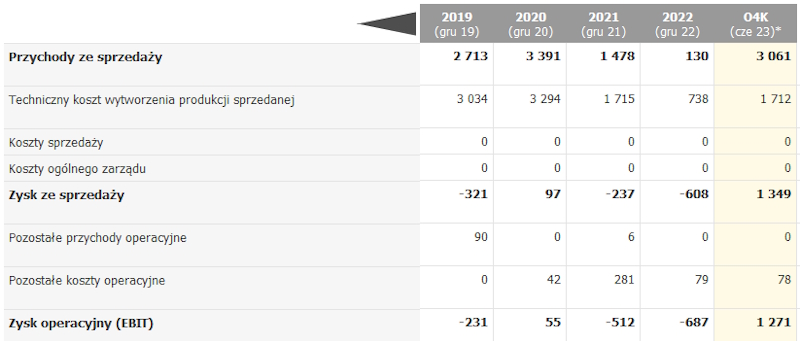

Source: Business Radar

Update: 27.09.2023:

In connection with inquiries addressed to the Company by Shareholders, the Board of Directors announces the status of work on the annual report and the independent auditor’s opinion.

The Board of Directors of the Issuer notifies that it has completed the release of all information, explanations and documents as of the beginning of this month. The work and approval of the unconsolidated annual report has been completed. The final details are currently being worked out and final adjustments are being made to the consolidated annual report. Unfortunately, declaring and setting a date for the complete completion of the work goes beyond our powers and responsibilities. At the same time, the objective increase in testing time is influenced by the fact that it is a repeat test, which makes it even more detailed, complicated and rigorous.

At the same time, the Board of Directors emphasizes the high quality and culture of cooperation between the Company and the audit firm and the accounting firm, which is completely different from the practice of the previous audit, including the actual deadlines for undertaking the audit. The Company’s management offers full readiness and has complete documentation and explanations for the ongoing work on the reports on an ongoing basis.

MBF Group

MBF Group